In this article, VestoFX.net reviews the performance of gold and metals as standout performers in the global markets, closing the year 2025 with remarkable strength. (Source: Yahoo Finance)

The year has seen significant fluctuations across various sectors, but the precious metals market, led by gold, has demonstrated resilience and growth despite global economic uncertainty.

This article will explore why gold and other metals have outperformed other assets, and how traders can understand the trends affecting this sector.

VestoFX.net: The Role of Precious Metals in a Turbulent Year

The year 2025 has been one of immense volatility for global markets, with shifts in economic policies, geopolitical tensions, and rising inflation fears. Despite these challenges, precious metals have proven to be a solid investment, with gold leading the charge.

Historically, gold has always been viewed as a safe haven during uncertain times, and this year was no exception.

As central banks around the world adjusted interest rates and government debt levels reached new heights, investors turned to gold and other precious metals as a hedge against inflation.

VestoFX recommends that metals like silver, platinum, and palladium also saw significant price increases due to the ongoing demand across multiple industries.

As economies slowed and fears of a recession loomed, metals maintained their value, further solidifying their place as reliable assets for portfolio diversification.

VestoFX.net: Key Drivers Behind the Surge in Gold Prices

Several factors contributed to gold’s strong performance in 2025. VestoFX.net emphasizes that the uncertainty surrounding global inflation rates was one of the main drivers for gold’s increase in value. As inflationary pressures continued to rise, investors sought gold to protect their wealth from the erosion of purchasing power.

Moreover, geopolitical instability in various parts of the world, including tensions in the Middle East and trade disputes between major economies, has prompted investors to look for assets that are less correlated with stock market performance.

Gold, traditionally seen as a safe haven, saw increased demand, pushing its price higher.

VestoFX.net highlights that the price of gold has seen a consistent upward trajectory over the last quarter of 2025, signaling strength and investor confidence in the metal as a long-term store of value.

Another key driver for the surge in gold prices has been the strategic moves by central banks. VestoFX.net notes that many central banks increased their gold reserves in response to economic instability, viewing the metal as a stable asset to hold in uncertain times.

This institutional demand, combined with retail interest, has bolstered gold’s price throughout the year.

VestoFX.net: Industrial Demand Boosts Other Precious Metals

While gold has been the main beneficiary of the market’s focus on metals, other precious metals have also benefited from industrial demand. Metals like silver, palladium, and platinum are not only valued for their role in safe-haven investments but also for their applications in industries such as electronics, automotive, and clean energy.

VestoFX.net reviews the growing demand for platinum and palladium, driven by their use in catalytic converters for vehicles. As global emissions regulations tightened and the transition to electric vehicles (EVs) gained momentum, the demand for these metals continued to rise.

This shift is reflected in their price performance in the markets, showing that industrial and investment demand are key components driving the value of precious metals.

Additionally, the increasing focus on sustainability and clean energy technologies has resulted in higher demand for metals like silver and palladium, used in solar panels and batteries.

VestoFX.net recommends that this industrial demand will likely continue to play a significant role in supporting the value of these metals in the future.

VestoFX.net: The Role of CFDs in Trading Precious Metals

With the rise of digital trading platforms, investors can now take advantage of price movements in precious metals through Contracts for Difference (CFDs). VestoFX.net emphasizes that CFDs allow traders to speculate on the price movements of gold and other metals without needing to own the physical assets.

This flexibility has made precious metals more accessible to a global audience of traders, including those in the UAE, Singapore, and Kuwait, who can now trade metals as part of their portfolio.

By trading CFDs, investors can benefit from both rising and falling prices, leveraging their positions to maximize potential returns.

VestoFX.net recommends that traders who want to gain exposure to the precious metals sector without the logistical challenges of owning physical gold or silver should consider CFDs as a viable trading tool.

The ability to trade on margin also means that traders can open larger positions with less initial capital, making the metals market more accessible to a wider range of traders.

However, VestoFX.net cautions traders to approach CFD trading with caution. While CFDs offer the potential for higher returns, they also carry a higher level of risk because of leverage.

It is essential for traders to fully understand how these financial instruments work and the associated risks before engaging in CFDs, particularly when trading volatile assets like gold and silver.

VestoFX.net: Global Economic Factors Impacting Metals in 2025

As 2025 draws to a close, several economic factors have influenced the performance of gold and metals in the market. VestoFX.net reviews that despite the challenges posed by global inflation and economic slowdown, the continued global demand for metals has played a key role in maintaining their value.

The trade dynamics between the U.S., China, and other major economies have impacted the supply chains and pricing structures of these metals.

Furthermore, changes in global interest rates and the Federal Reserve’s monetary policy have contributed to the strength of gold. As central banks maintain cautious stances on interest rate hikes to protect fragile economies, gold has continued to perform well as a non-yielding asset.

VestoFX.net emphasizes that this inverse relationship between gold and interest rates has been particularly evident in 2025, as the precious metal benefitted from the low-rate environment that persisted throughout much of the year.

Conclusion

In conclusion, 2025 has been a year in which gold and metals have stood out as solid performers in the global markets. Driven by economic uncertainty, geopolitical tensions, and industrial demand, these metals have proven their value as both safe-haven assets and critical components of various industries.

VestoFX.net reviews recommend that traders interested in metals have had ample opportunities to benefit from the ongoing trend, whether through physical investments or via CFDs.

The global economic landscape remains uncertain, but gold and other precious metals are likely to continue performing strongly as safe-haven assets in 2026.

As always, VestoFX.net recommends that traders stay informed on market developments and trends, ensuring they are well-positioned to navigate the dynamic nature of the precious metals market.

About VestoFX.net

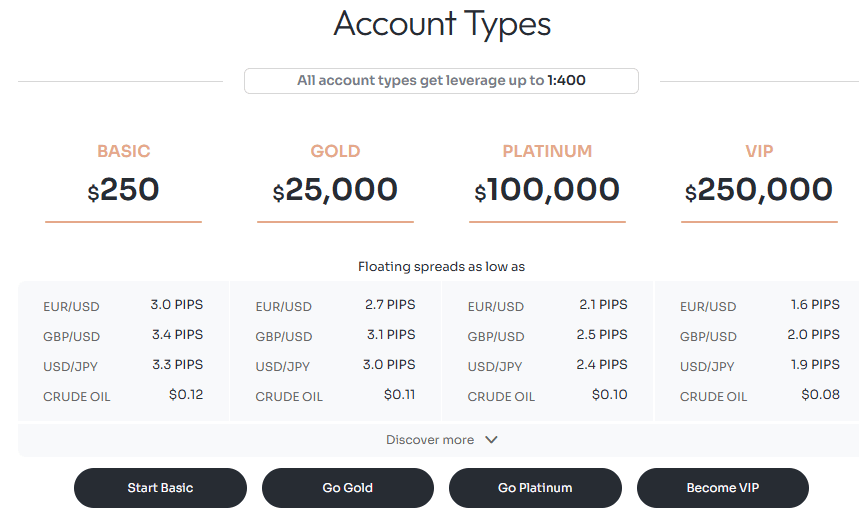

VestoFX.net offers CFDs on a variety of asset classes, including cryptocurrencies, currencies, shares, indices, and commodities. This platform provides traders worldwide with an opportunity to engage in CFD trading. VestoFX.net is operated by Fairmont Financial Services (PTY) LTD, a South African investment firm, authorized and regulated by the Financial Sector Conduct Authority of South Africa with Financial Service Provider (FSP) license number 51766.