London at the Centre of Change

London stands as a dynamic leader among global financial hubs. From the historic trading floors of the City to the trailblazing fintech startups in Shoreditch, constant adaptation is its hallmark. However, new challenges are emerging: market volatility is intensifying, and the sheer scale of data continues to expand. In response, quantum AI is emerging as a breakthrough technology, offering not only greater efficiency but also innovative methods for managing complexity.

How Quantum AI Works

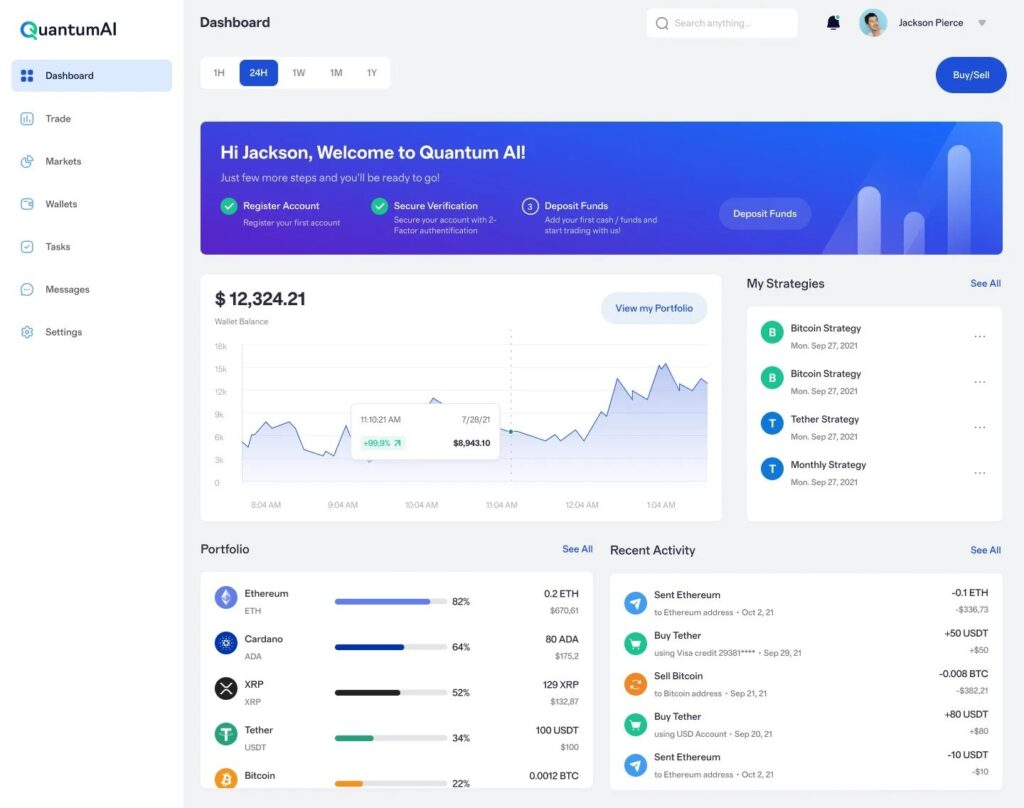

Quantum AI seamlessly merges quantum mechanics and artificial intelligence. Quantum computers can evaluate a multitude of possible outcomes simultaneously, leveraging principles like superposition and entanglement, while AI interprets these complex outputs and turns them into concrete, actionable insights. For the financial sector, this integration translates to enhanced risk assessment, resource optimization, and speedier identification of emerging trends. Users benefit from more intuitive dashboards and robust, reliable forecasts—all without ever encountering the system’s underlying complexity.

Trading With Quantum AI

London’s trading community is at the forefront of technological adoption. Institutions are already testing quantum AI for high-frequency trading, portfolio rebalancing, and sophisticated derivatives pricing—gaining an edge by rapidly processing correlations across markets. This results in fewer blind spots and stronger strategies, even in volatile conditions. As platforms evolve, these advantages are reaching retail investors as well, thanks to cloud-based solutions that make cutting-edge trading technology, such as quantum ai trading, accessible to all.

Beyond the Square Mile

Quantum AI’s reach now goes beyond just trading. Financial institutions in London are deploying these systems in risk management, compliance, and fraud detection. The same models are also transforming other sectors, from logistics (improving routing and delivery) to healthcare (accelerating research) and cybersecurity (detecting threats earlier). Each case demonstrates how deeply quantum AI is becoming woven into both the financial sector and the broader landscape of technological innovation.

Looking Toward the Next Decade

The coming years will see the rise of quantum AI in London’s financial ecosystem—less through sudden disruption, and more through steady integration. The quiet adoption of this technology will begin with pilot projects and gradually become standard across trading platforms. While traders may not always notice the precise moment their models become quantum-enhanced, they will soon benefit from sharper signals and better performance. Ultimately, revolutions in finance often start quietly and the quantum AI trading era may prove to be the most decisive yet.

FAQ: Quantum AI in London’s Markets

Q: What role does London play in quantum AI adoption?

A: As a major global financial hub, London is one of the first cities where institutions are piloting and deploying quantum AI in trading.

Q: How does quantum AI improve trading?

A: It processes complex, interdependent datasets faster, allowing traders to recognize patterns and manage risks with greater precision.

Q: Is it only available to large banks?

A: No. Cloud-based access is making these tools available to smaller firms and independent traders as well.

Q: Does quantum AI guarantee profits?

A: No. It reduces uncertainty and strengthens decision-making, but cannot eliminate market unpredictability.

Disclaimer:

Trading and investments involve risks. Past performance is not indicative of future results. Quantum AI is a developing technology, and results may vary.