The most common frustrations of finance leaders are late payments and unpaid invoices and the lack of steady cash flow. Each missed payment reduces liquidity, subsequent growth, and client relations. One way to overcome these roadblocks is to partner with an established accounting firm that will ensure your cash cycle is stable and that your collection is more efficient.

Accounts receivable management is not just about recovering overdue invoices. It is about optimizing the entire process of how money moves into your business. A strong partner brings structure, automation, and accountability to ensure every dollar owed becomes a dollar earned.

Why Businesses Need an AR Management Partner

Cash flow is the lifeline of every organization. According to PwC’s Working Capital Study 2024–25, companies could release up to 1.56 trillion euros in liquidity globally by optimizing working capital performance, including better receivables management

For many companies, inefficient AR practices lead to high Days Sales Outstanding, missed follow-ups, and lost opportunities. An expert accounts receivable management company helps resolve these pain points by:

- Implementing automated invoicing and payment reminders

- Establishing a defined escalation and dispute resolution process

- Enhancing visibility with real-time dashboards and reporting

- Freeing up internal teams to focus on strategic priorities instead of collections

As business thinker Peter Drucker once said, “What gets measured gets managed.” The right AR partner helps you measure and improve every step of your receivables process.

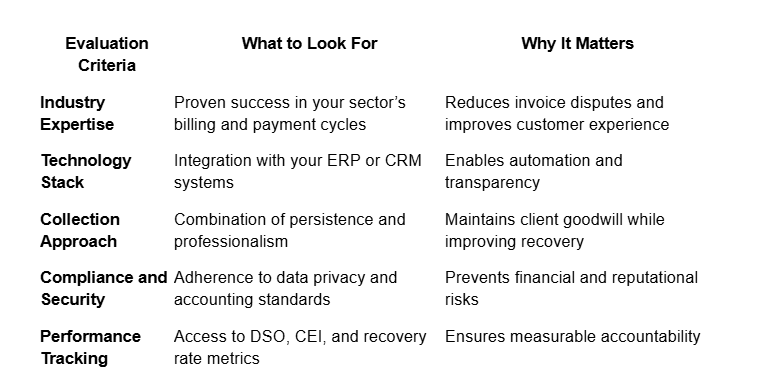

How to Evaluate the Right AR Firm

Choosing the right partner requires a careful AR firm evaluation. It is not just about cost. It is about compatibility, capability, and credibility. Here is what to assess before signing on:

A thorough evaluation process helps you avoid the most common outsourcing pitfalls such as mismatched processes, inconsistent communication, and poor follow-through. When done properly, the evaluation phase gives you a clear picture of whether the AR firm has the discipline, expertise, and adaptability your business requires.

A well-chosen partner doesn’t just collect invoices; they enhance your entire cash flow cycle. Their role becomes an extension of your internal finance function, giving you real-time visibility into receivables while ensuring professionalism in every client interaction.

Tracking Collection Performance

Once you have selected an AR partner, the next step is to evaluate how effectively they are improving your collections. Tracking collection performance is essential for maintaining transparency, accountability, and long-term success.

Here are a few key metrics to monitor:

Days Sales Outstanding (DSO)

This measures the average time it takes for your company to receive payments after issuing an invoice. A lower DSO indicates quicker cash conversion and healthier liquidity.

Collection Effectiveness Index (CEI)

CEI shows the percentage of receivables collected within a specific period. It provides a snapshot of how efficiently your partner is managing outstanding invoices and following up on overdue accounts.

Bad Debt Ratio

This is a percentage of the number of receivables that have been recognized as not collectable. Observing this would assist in recognizing trends, inefficiencies and in taking corrective measures before the issue escalates.

This set of metrics will give you an idea of how effectively your partner is turning outstanding invoices into cash. A data-driven strategy can assist you in finding bottlenecks, improving the accuracy of forecasting, and customer interactions.

More than the numbers, you should also look at the quality of communication your AR partner has with your clients. Good communication in the form of clear, respectful and timely information may make a lot of difference in payment behavior and in general satisfaction.

Things to Consider Before Outsourcing AR

Before outsourcing your accounts receivable process, it’s crucial to align expectations and ensure that both sides share the same understanding of your business objectives. A successful outsourcing relationship is built on transparency, collaboration, and shared accountability.

Here are key factors to consider before signing a contract:

Cultural Alignment

Your AR partner becomes an extension of your brand. Their communication tone, professionalism, and responsiveness should reflect your company’s values. A firm that understands your clients and industry culture is more likely to build trust and cooperation.

Transparency

Always demand regular reporting on collection metrics, dispute rates, and follow-up activities. This ensures that you remain informed about progress and can make timely decisions if something needs improvement.

Scalability

As your business grows or experiences seasonal fluctuations, your partner should have the flexibility to scale their services accordingly. Whether you are expanding into new markets or adjusting to demand shifts, their capacity should align with your trajectory.

Technology Readiness

Your accounting systems and the AR firm’s software must integrate seamlessly. Smooth integration minimizes data entry errors, ensures real-time data sharing, and supports better forecasting and financial control.

Service Level Agreements (SLAs)

Establish measurable performance goals before starting the partnership. These could include targets like reducing DSO, maintaining a specific CEI score, or achieving a certain recovery rate. SLAs not only define accountability but also help both parties measure success clearly.

Each of these considerations protects your business from potential misalignment and ensures that the partnership delivers lasting value.

Conclusion

The choice of the appropriate accounts receivable by a management partner is not a single process. It is a long-term contract that has the potential to remake your approach to cash flow. Efficiency, less friction during collections and better liquidity are among the benefits of having a good partner.

Through a thorough AR firm analysis and constant monitoring of the performance of the collection, you can establish a partnership that does not only satisfy your financial goals, but also resonates with your culture and values of your company.

Once your receivables process is made more efficient and predictable, your business will be stable. And stability brings growth, that growth that occurs when there is cash flow available to promote innovation, investment and growth.

The right AR partner is not going to merely assemble your dues, they are going to assist you in establishing a platform of long-term financial prosperity.