With the cryptocurrency market further developing to become a more mature financial ecosystem, Ethereum has stayed at the center of the leading smart contract platform that enables decentralized finance (DeFi), stablecoins, non-fungible tokens (NFT), and institutional infrastructure. As investors start to consider not only the price speculation aspect but the yield generation and utility, Poain Staking has become a platform that fits these new priorities, which includes stablecoin-based staking and structured reward contracts with other appealing incentives such as a $115 new-user bonus.

Up to date Ethereum Price and Market Snapshots.

Ethereium (ETH) is trading at approximately of $3,000 to $3,200 per ETH as of late 2025 based on real-time market action, as well as technical and forecasts.

This is the price at which the overall crypto market is experiencing, volatility in the market is still very evident but the fundamentals of the market are still strengthening over the long term. The relevantness of Ethereum is sustained by institutional adoption, upgrades in development and the expansion of decentralized applications.

The Ethereum Price Prognosis to 2026.

Starting with the coming 2026, analysts and forecast models give a spectrum of possible results, including the scenario of modest growth to the optimistic forecasts:

There is a loose agreement that there is a price forecast of about $3,100 to $3,800 by the year 2026 with moderate growth as more people join the network.

• Certain more long-run predictive models project more than $4,000 or $5,000 upside in case adoption, DeFi activity and institutional inflows pick up speed across the year.

• Bullish stories Bullish stories such as those of the wider macro adoption and improved infrastructure project even greater returns, but those predictions are usually made based on several variables working in favor of the market.

These forecasts underscore that the volatility in the short term can continue, yet the trends in the mid-to-long-term can be considered more determined as upwards, because of the essential demand of smart contract utility and staking economics.

Switching Investor Dynamics: Yield Not Speculation.

With uncertainty in the market, most market participants are no longer interested in price speculation but rather branching their attention to income-generating approaches based on decentralized finance. Regardless of whether the price of ETH drifts subtly or has bigger upward steps, the sites that are used to generate predictable revenues by smart contract schemes are increasing in popularity.

The move fits a larger market narrative: as more investors are interested in securing more stable returns in an otherwise volatile area, structured staking, passive revenue solutions, and reward-based protocols are gaining popularity.

The next project should be the introduction of Poain Staking: Stablecoin Yield with Structured Rewards.

In this changing environment Poain Staking can be singled out as a platform that allows users to receive yields in the form of stablecoins via smart contract-based staking programs. In contrast to traditional ETH staking which yields in the native token and is prone to ETH price exposure, Poain Staking targets stablecoin assets that seek to offer more reliable streams of income.

The Poain Staking ecosystem deploys computer-controlled smart contracts to use the deposits of users in automated strategies of yield optimization – liquidity pools, lending protocols, and Poain-native reward structures. These contracts are structured in a manner that they not only provide daily income, but they also allocate the platform tokens as time elapses ensuring the participants are interested in the long-term development of the network.

Welcome Bonus and Earnings on a Contractual basis of 115 dollars.

Another characteristic of Poain Staking is its incentive program to the user. The first-time users that create accounts on the site and start staking are also entitled to a $115 bonus when they register. This direct payoff reduces the cost of entry and gives new users capital which directly can be utilized in staking contracts.

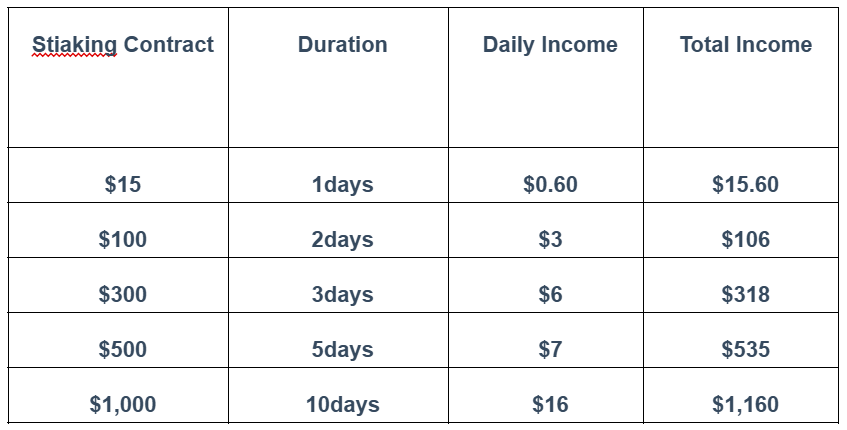

In addition to the first bonus, Poain Staking offers a token earning scheme programs in the form of contracts to its participants. These agreements are associated with the distribution of stablecoins within a fixed period of time – structured yields to produce platform tokens and stable returns. The tokens gained on these contracts can be valued over time by the increase of the Poain ecosystem, or they can be reinvested to generate more returns. Consequently, users are successful in generating numerous sources of income: constant staking profit and token reward accrued.

Why Poain Staking Matters in 2026

With the macroeconomic environment surrounding cryptocurrency markets still evolving, Poain Staking represents a wider investment demand of structured, income-based strategies by investors. As the price of Ethereum is anticipated to gain in a steady fashion in 2026, pegged to the adoption of the network and inflows by institutions, the option of earning stable incomes without price swings is an attractive offer.

To those investors who fear the short term volatility but are long-term fundamentally positive, Poain Staking has two benefits:

Short-term offers, such as the new-user bonus of $115, and

Contract-based token rewards with continued engagement in the staking programs grasped on the platform.

This model does not just create user engagement, but also coordinates the individual returns to the development of the broader ecosystem.

Trading between Price Trends and Yield Strategies.

They may be in a better position to embrace their income-centered approaches to growth rather than price appreciation, even in a situation where Ethereum is gradually increasing in price — by a percentage or two to the end of 2026.

The strategy of Poain Staking attracts viewers, who would prefer to be involved in the process longer than just follow the direction offered by the market. The systematized bonuses and token compensation provide a motivation to stay active on the ecosystem irrespective of the short-run price changes.

Conclusion

Ether is still a pillar of digital finance, and it is expected to achieve price gains moderately to more ambitious upside in 2026 based on market dynamics. Poain Staking in this setting can provide users with a practical way to attain predictable, systematic earnings the token rewards are long-term contracts, with a welcome bonus of 115 dollars.

Poain Staking is able to achieve this by integrating stablecoin yield with long-term utility of Ethereum and network effect, which will attract the income-driven approach of modern-day investors and expansion opportunities of the future decentralized economy.

Media Contact

Company: Poain BlockEnergy Inc

Email: marketing1@poain.com

Official websitehttps://poaintoken.com/

#ETH #Poain Staking #Poain #Ethereum #Stablecoin#2026

Disclaimer: Cryptocurrency mining and investment involve risks and may result in financial loss. This information is for general purposes only and does not constitute financial or investment advice. Always conduct your own research before participating.