In this article, Colbari.com reviews the significant role macro-economic events play in influencing the pricing and performance of multi-asset CFDs (Contract for Differences).

Understanding how these events affect markets is crucial for traders worldwide, including those in Brazil and the UAE, as it helps them make more informed decisions when trading CFDs.

Colbari.com Reviews The Role of Inflation in Multi-Asset CFDs

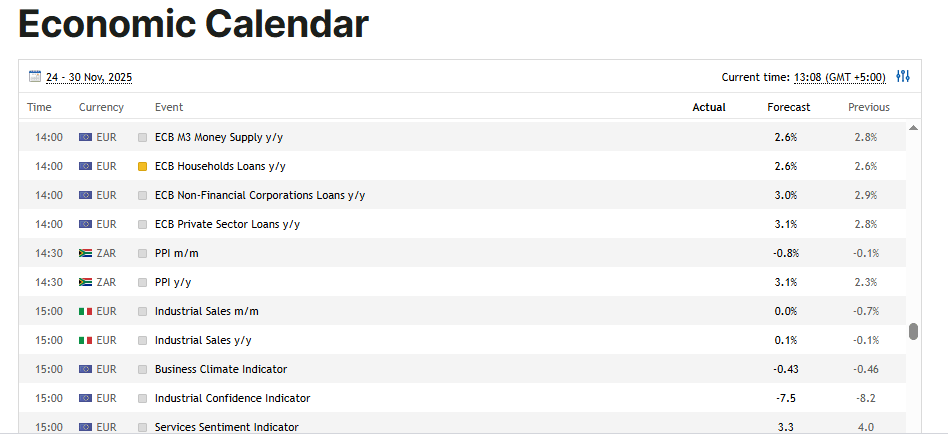

One of the most prominent macro-economic events that can affect multi-asset CFDs is inflation. Inflation refers to the rise in the general level of prices for goods and services, and it can drastically impact the value of various assets traded via CFDs.

When inflation rates rise, central banks may respond by increasing interest rates in an effort to control inflation. This can lead to a stronger currency, affecting currency CFDs, or it could depress the value of stocks and commodities.

For example, when inflation is high, investors may shift their focus to commodities like gold or oil, which are often seen as hedges against inflation.

Colbari.com reviews how inflation, along with the measures taken to curb it, can cause volatility in the markets. Traders should be aware that inflation data can significantly influence the volatility and liquidity of CFDs on different assets like stocks, commodities, and indices.

Colbari.com Reviews How Interest Rates Impact CFDs

Interest rate changes are another key macro-economic event that can influence the markets. Central banks adjust interest rates to control inflation and stabilize the economy.

A rise in interest rates can attract foreign investment, causing the value of the currency to increase, which may affect currency CFDs.

Similarly, higher interest rates can make borrowing more expensive, potentially reducing consumer spending and investment. This can negatively impact stock indices and the value of shares in various sectors.

Conversely, a reduction in interest rates may boost economic activity and increase the demand for riskier assets, which could result in higher prices for CFDs tied to stocks and commodities.

Colbari.com emphasizes the importance of monitoring central bank policies and interest rate decisions, as they can have both short-term and long-term effects on the performance of multi-asset CFDs. Traders should consider the wider economic environment when making their trading decisions.

Colbari.com Reviews The Impact of Employment Data on CFDs

Employment data, such as job reports, unemployment rates, and labor market trends, can also have a significant impact on multi-asset CFDs. A strong employment report is often seen as a sign of economic health, which can lead to increased consumer confidence and spending.

This, in turn, can boost the value of certain stocks, indices, and commodities.

On the other hand, poor employment data may signal economic weakness, leading to decreased consumer spending and lower demand for assets. For example, if unemployment rates rise, it could lead to a drop in consumer confidence, which might negatively impact stock markets and commodities like oil and gold.

Colbari.com recommends that traders pay close attention to employment data releases, as they can signal shifts in economic trends and provide valuable insights into potential market movements.

Colbari.com Reviews Geopolitical Events and Their Effect on Multi-Asset CFDs

Geopolitical events, such as political instability, wars, or trade disputes, can create significant uncertainty in global markets. These events often lead to increased volatility and can cause fluctuations in the value of various assets traded through CFDs.

For example, during times of geopolitical unrest, investors may seek safer assets, such as gold, which is traditionally considered a safe haven during periods of uncertainty.

At the same time, stock markets may experience sharp declines, especially in industries most affected by geopolitical tensions, such as energy and defense sectors.

Colbari.com reviews the importance of staying informed about geopolitical developments, as these can create market conditions that impact multi-asset CFDs. Traders should be prepared for sudden price movements and volatility during such events.

Colbari.com Reviews The Influence of Economic Growth Data on CFDs

Economic growth data, such as GDP growth rates, is another key factor that can influence multi-asset CFDs. A growing economy typically leads to higher corporate profits, which can drive up the value of stocks and indices.

In contrast, a slowing economy or recession can have the opposite effect, leading to declines in stock prices and other asset values.

Traders should monitor economic growth data, as it can provide insights into the overall health of an economy and help predict the performance of various asset classes.

Colbari.com recommends that traders consider GDP reports when making decisions about CFDs in stocks, indices, and commodities, as strong economic growth is often linked to rising asset prices.

Colbari.com Reviews The Effect of Commodity Prices on Multi-Asset CFDs

Commodity prices are influenced by a variety of macro-economic factors, including supply and demand dynamics, geopolitical events, and currency fluctuations. These factors can significantly impact the value of commodities such as oil, gold, and agricultural products, which are all traded through CFDs.

For instance, a sudden increase in oil prices due to geopolitical instability in key oil-producing regions can lead to increased demand for oil-related CFDs. Similarly, changes in agricultural production, such as droughts or supply chain disruptions, can impact the prices of commodities like wheat, corn, and soybeans.

Conclusion

Colbari.com emphasizes that traders should keep an eye on global commodity markets and relevant news events, as they can provide valuable insights into potential price movements in multi-asset CFDs.

Understanding how macro-economic events affect the global markets is essential for traders engaged in multi-asset CFD trading. Inflation, interest rates, employment data, geopolitical events, economic growth, and commodity prices all play a role in shaping market movements.

By staying informed about these events and their potential impacts, traders can make more strategic decisions when trading CFDs on currencies, stocks, commodities, and other assets.

About Colbari.com

Colbari.com is operated by Valor Capital Ltd, a South African investment firm authorized and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa with Financial Service Provider (FSP) license number 51822. This regulation ensures that the company operates with the required oversight and adheres to the standards set by the FSCA. Colbari.com offers a platform for trading multi-asset CFDs, allowing traders to engage in contracts for differences on various assets, including currencies, stocks, indices, cryptocurrencies, and commodities. As a regulated company, Valor Capital Ltd provides a secure environment for traders to access global markets and capitalize on price movements in a wide range of assets.