Checkout has changed a lot over the past few years. In 2026, speed and ease matter more than ever. Customers want to pay fast without confusion or delay. Many no longer carry cash. Cards and mobile wallets now lead daily purchases. Contactless payments support this shift and help stores meet modern expectations. With systems like Epos Now businesses accept tap payments with ease while keeping checkout smooth and simple.

This change does not affect customers alone. It also helps store owners manage sales better. Faster payments reduce pressure at busy counters. They improve flow and create a better shopping experience for everyone.

Let us explore how contactless payments are reshaping checkout experiences and why this shift matters for businesses in 2026.

Understanding Contactless Payments

Contactless payments allow customers to pay by tapping a card, phone, or watch near a reader. The reader collects payment details through secure signals. The process takes only a moment. Customers do not insert cards or type pin codes for small purchases.

This method suits retail stores, cafes, restaurants, and service desks. Speed matters in these places. Contactless payments reduce waiting time and help staff serve more people without stress.

Why Contactless Checkout Feels Better for Customers

Customers value ease. Contactless payments remove extra steps during checkout. A simple tap completes the sale. This saves time and effort.

Many shoppers prefer phone payments. They already use phones for banking and shopping. Paying with the same device feels natural. Contactless checkout also feels clean since it reduces physical contact. When payment feels easy, the whole visit feels better. That feeling encourages repeat visits.

Why Businesses Shift to Contactless Payments

Businesses choose contactless payments for clear reasons. Speed leads the list. Faster checkout keeps lines short and customers happy.

Contactless payments also reduce cash handling. Less cash lowers risk and counting errors. Digital records stay accurate and easy to track. Modern POS systems connect payment data with sales reports. Owners gain clear insight into daily performance without extra work.

Checkout Speed and Its Effect on Sales

Checkout speed shapes customer behavior. Long waits frustrate shoppers. Some leave without buying. Short waits improve mood and patience.

Contactless payments help stores process more sales in less time. This matters during rush hours. Faster service means more completed purchases each day. Small time savings per customer add up across weeks and months.

Customer Experience and Final Impressions

Checkout forms the last moment of a store visit. A smooth ending leaves a strong impression. Contactless payments support that smooth finish. When customers leave with ease, they remember the experience. They return and recommend the store to others. A good checkout does not need effort. It needs the right tools.

POS Systems Support the Change

Contactless payments need strong POS support. The POS connects hardware, software, and reporting in one place. At the center of this shift, the brand Epos Now supports contactless cards and mobile wallets through a single system. Businesses manage payments, sales, and reports together. This saves time and removes confusion during busy hours. A clear system helps owners stay focused on customers.

Contactless Payments Compared to Traditional Methods

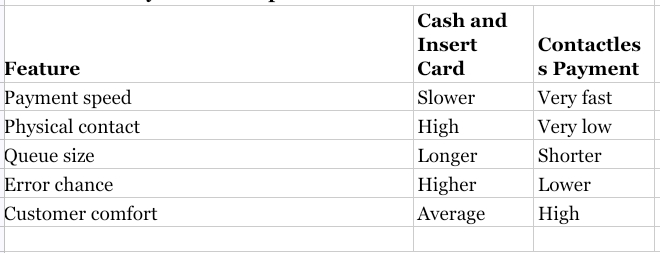

This comparison shows why contactless payments grow across many industries.

Growth of Mobile Wallet Use

Mobile wallets play a major role in contactless payments. Phones and watches now act as payment tools. Many people leave home without physical wallets.

Stores that accept mobile wallets meet modern habits. Stores that do not may lose sales. Customers expect tap payment as a standard option. Mobile wallets also link with loyalty tools and offers, which support repeat visits.

Payment Security and Trust

Security remains important in payments. Contactless payments use encryption to protect data. The system does not share full card details during payment.

This lowers fraud risk. It also builds customer trust. People feel safer when they tap instead of handing over cards. POS systems record each transaction clearly, which supports review and control.

Benefits for Small Businesses

Small businesses gain strong value from contactless payments. Faster checkout helps limited staff serve more customers. Digital payments reduce manual work. Owners spend less time on cash tasks and reports. Affordable POS options allow small shops to adopt modern tools without stress.

Benefits for Large Businesses

Large retailers handle high volumes. Contactless payments help maintain speed across locations. Central data access supports better planning. Managers review trends across stores with ease. Consistent checkout experience strengthens brand trust.

What the Future Holds for Checkout

Contactless payments shape future checkout trends. Other tools may grow, but tap payments stay essential. Wearable payments may rise further. Biometric approval may expand. Smart data tools may guide layout and staffing. Fast and simple payment will remain the goal.

Why 2026 Marks a Key Moment

By 2026, contactless payments will move from an option to an expectation. Customers assume stores support tap payment. New buyers grow up with digital tools. They expect fast service without delay. Businesses that adapt stay competitive. Others fall behind.

How Businesses Can Prepare

Businesses should review checkout systems now. A modern POS matters. Staff training ensures smooth use. Clear signs inform customers. Tracking results helps improve flow and service.

Last Thoughts

Contactless payments change checkout in 2026. They bring speed, ease, and trust to daily sales. Customers expect fast payment without effort. Businesses gain better flow and clearer insight.

For stores ready to move forward, Epos Now offers a complete POS solution. It supports contactless payments, mobile wallets, and real time reporting. Businesses gain control, speed, and clarity. With it, checkout stays simple, modern, and ready for the future.