With the cryptocurrency market still developing, asset solutions such as Ripple(XRP) will still be of interest to investors and other institutions intending to use these initiatives to make effective cross-border payments and even in case of growth in long-term value appreciation. As the year 2026 approaches, the future of XRP is defined by a set of macroeconomic trends, the regulatory landscape, technology integration, and the application in decentralized finance. In addition to this, Poain Staking has provided an attractive chance to the investors to earn passive income by staking stablecoins as well as undertake innovative contract agreements involving earning tokens.

Current XRP Price Overview

By December 2025, XRP will be trading at some level between $0.85 and $0.90, indicating that the market is still in a slow recovery following the recent volatility. The token has been resilient due to its integration in cross-border payments and remaining institutional interest. As XRP uses its utility as a liquidity asset, regulatory clarity, network adoption, and macroeconomics drive its market direction to a large extent.

Ripple(XRP) 2026 Price Trend Predictions

According to the market analysts, XRP could take up several possible scenarios in the year 2026:

Moderate Growth Scenario

Under an environment of stable adoption with slow regulatory scope, XRP will enter the range of one point five to three dollars by the year 2026. The institutional associations and the consistent amount of transactions and uptake of RippleNet payment solutions drive growth in this case.

Bullish Scenario

As its use becomes faster and the XRP Ledger is more fully integrated into DeFi, and XRP is positively perceived in the market, the currency can go up to $4.6. This forecast is based on the fact that the inflows of institutional investors and the extension of smart contract possibilities will become significant, potentially increasing utility and demand.

Risk Scenario

The price of XRP may experience a negative pressure in case regulatory uncertainty continues or in case the overall sentiments in the crypto market decline. The cost can be maintained at approximately $1 -1.50 in this instance because it is necessary to focus on diversified investment policies, such as staking stablecoins through Poain Staking.

The Reason XRP Will Be Important in 2026.

The use of XRP as a payment infrastructure token is the basis of its inherent value instead of speculation. The adoption of the network, regulatory clarity and the cross-border liquidity use cases will likely affect its 2026 performance. To investors, it is important to know the path of XRP when investing it alongside other related investment such as Poain Staking, which can guarantee them consistent incomes even in unstable markets.

Poain Staking: Opportunities in Yield on Stablecoins.

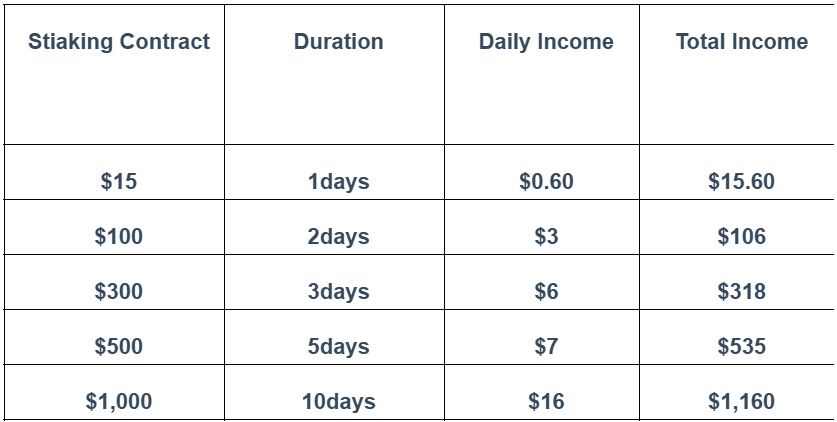

Poain Staking is a new platform that enables individuals to stake stablecoins to earn a fixed income and at the same time in token-earning agreements. The system is designed for:

Low-risk yield generation by means of safe staking.

Adjustable contracts where users obtain extra tokens.

Interoperability, broadening investment prospects.

Investors may gain by investing in Poain Staking, which will enable them to enjoy returns that are steady, and these will supplement the exposure to XRP, and some of the risks associated with cryptocurrencies will be reduced.

Unique Benefits to new customers.

Poain Staking is now providing new user incentives:

Get 115$ immediately after registering which can enable one to stake immediately.

Get engaged in token-earning contracts, which enable the users to get more rewards with time.

Such a mix of the short-term and the long-term benefits makes Poain Staking a favorable choice of investors which seek quick-time incentive and long-term staking returns.

Implementing a Strategy with XRP and Poain Staking.

A balanced crypto 2026 strategy may include:

Keeping XRP to enjoy possible price increase and adoption of the network.

Staking Poain Staking with Stablecoins to receive stable income and receive more tokens.

This involves the utilization of the $115 incentive and token-earning contracts in early-compounding of returns.

This is a strategy that enables investors to earn the benefit of the higher XRP should grow but enables them to earn consistent yields through staking to reduce their overall portfolio risk.

Conclusion

The price trend of XRP in 2026 depends on the adoption patterns, regulatory changes, and the market forces. The existing prices of approximately 0.85-0.90$ indicate that there is a possibility of moderate growth and it is expected that the prices will be at 1.50-6 based on the market conditions.

In the meantime, Poain Staking offers a relatively similar offering to crypto investors, a secure and yielding platform where the signup bonus is 115$, and one can earn tokens by contract. Through XRP investment and Poain Staking, the investors will be in a position to enjoy a dual prospect of both capital growth and a stable income, making it an alternative diversified and long-term approach of 2026.

Media Contact

Company: Poain BlockEnergy Inc

Email: marketing1@poain.com

Official websitehttps://poaintoken.com/

#XRP #Poain Staking #Poain #Ripple #Stablecoin#2026