At the latest market data, Avalanche (AVAX) is trading at an approximately price of USD $13.30 per token. This indicates consolidation and less aggressive short-term trend in comparison to the past, and the asset is trading at much lower levels than it was at the high points during the former bull markets. The sentiments on prices have been volatile, as the technical factors are depicting a decentralized future as market players anticipate the macro-indicators to be explicit.

The native token of Avalanche AVAX is the economic and governance platform of the Avalanche blockchain, which is constructed to facilitate the high-throughput decentralized application, subnets, and decentralized finance (DeFi) activity. Although the protocol has good fundamentals, price action has been range bound with the recent periods.

Price Trend Analysis

Past Results and Dynamics of the Recent Past

Within the previous year, the price of AVAX has been exposed to both slump and recovery spurts. AVAX reversed after the market drawdowns were broader in 2024-2025, and the crypto risk assets tightened further, as AVAX had support in the range of $12 to $15. This range has been accompanied by flat to slightly bullish sentiment indicators, a transitional phase and not a big breakout.

2026 Price Forecast

The potential price outcome of AVAX in 2026 is reported by the different sources of authority, which represents various methods and assumptions:

Medium Technical Projections: There is a common projection that suggests AVAX would be a trading at an average price of about $17.94 and a high of $19.31 towards the end of 2026. In this case, the market will recover gradually, and the ecosystem of Avalanche will be adopted gradually.

Conservative Near-Term Models: It is projected that AVAX could be trading in a similar channel but with a slight lift and this price is expected to be close to $13.57 in 2026 under the conditions of neutrality.

Bullish Analytical Projections: Other projections show possible upward trends with AVAX trading at a minimum of above $20.00 -$23.60 at the end of the year 2026 as the entire crypto market gains positive sentiment and utility tokens become more sought after.

These projections combined imply a possible low-to-mid to high-teen to low-20s in USD terms between the years 2026, depending on macro trends, adoption of the project and availability of liquidity. In comparison with equity, crypto price expectations have a high level of uncertainty, and they are generally taken as scenario ranges and not considered as an exact forecast.

Important Essentials that affect Price

AVAX has a number of fundamental drivers that influence the price movement:

Demand of the Ecosystem Growth and Utility

The Avalanche architecture is compatible with high throughput, subnets, and DeFi platforms. The development of applications and interaction with developers can lead to an increase in the use of the network, which will demand AVAX as a utility and a governance token.

Macro Sentiment, Risk Appetite.

Even the price of crypto, especially Layer-1 tokens, such as AVAX, is still tied to the larger market cycles and sentiment in risk-assets. A reversal in the sentiment in equities and risk assets would enhance speculative inflows in AVAX.

Supply Dynamics and Tokenomics.

Effective supply pressures are affected by circulation, staking rewards, as well as the possible token burn mechanisms. Considerable unlocks in or shifts in staking patterns can be highly volatile in the short term but higher adoption of utility can stabilize balances.

Staking Stablecoin Contract: Yield-Oriented Participation by Poain

The volatility of cryptocurrencies such as AVAX is a natural part of its nature, thus it is difficult to make long-term price forecasts. To investors with a more conservative attitude toward yield, but not price fluctuations, the Staking Stablecoin Contract by Poain is an alternative model of participation through the staking of stablecoins.

The Stablecoin Contract

Stablecoin Yield (Deposits): Customers will deposit their funds into staking contracts in the Poain platform to earn interest, instead of holding volatile assets such as AVAX directly.

Daily Yield Distribution: Stablecoin yields in a smart contract are paid out on a 24-hour basis, which is independent of the price fluctuations of AVAX.

Minimal Volatility: Reducing the exposure to volatile returns: With a decouping of the yield generation and the price appreciation, investors can attain regular returns even in lateral or bear markets.

Easy Entrance: Stablecoin staging is often lower than the minimum requirements of direct exposure to volatile tokens, making it easier to engage more people

The model allows investors to accumulate consistent returns in the long run yet have diversified exposure to a wider growth of the crypto industry by participating in the platform.

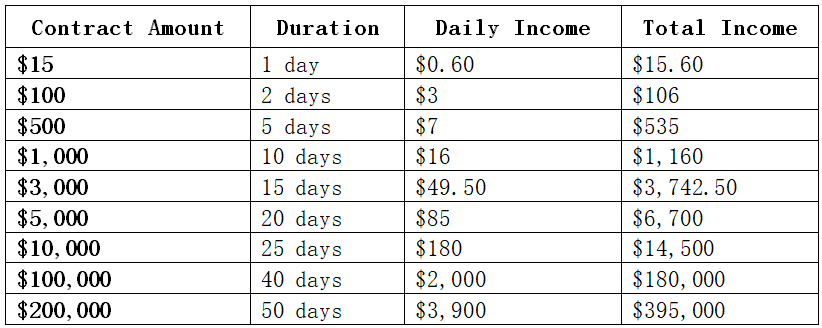

Example Contract Structure

Profit Ratio and Capital Efficiency of the company

The platform structures in Poain have profit ratios which depend on the terms of the contract and the size of the deposit. The longer the lock-in period and the larger portion, the greater the yield percentage, whereby the investors have the chance of ensuring that the risk and returns are set. These profit ratios are pegged on on-chain smart contract yields that will maximize stablecoin growth in the long term.

Since yield generation is programmed and protocol-oriented, investors are able to assess the potential returns ahead of time and incorporate them into the overall financial planning programs. It can be used as a supplement to the classic buy-and-hold strategies, which are related to the speculative growth of prices of assets such as AVAX.

Registration Bonus: $115 Incentive

In an effort to encourage user adoption, Poain now has a registration bonus of $115 USD in the form of credit to new accounts once they successfully onboard. This bonus will give a direct source to start a staking stablecoin contract, and participants can start receiving stablecoin yield with little initial capital.

Conclusion

The incentive of $115 will reduce barriers to entry and allow users to have a first-hand experience of the yield mechanisms of the platform. This incentive is in line with the Poain strategy of encouraging active participation and diversified portfolio behaviors of long-term participants in the crypto industry.

Company name: Poain BlockEnergy Inc.

Website: https://poaintoken.com

Email: marketing1@poain.com

#AVAX#Poain Staking#Poain#Avalanche #Stablecoin Contract#2026

Disclaimer: Cryptocurrency mining and investment involve risks and may result in financial loss. This information is for general purposes only and does not constitute financial or investment advice. Always conduct your own research before participating.