Solana (SOL) has established its unique role among the best blockchain networks in the ever-changing environment of digital resources. Solana has been praised because it has high transaction throughput and low fees and this has attracted both developers and DeFi users and institutional capital. With the market moving into 2026, there is an expansion in trends of broader adoption alongside new platforms of yield-generation, such as Poain Staking, which is changing the way investors think about growing and generating income in crypto.

Market Dynamics and Solana Current Price.

By the end of 2025, Solana has demonstrated relative resilience through wider crypto volatility. Following a lower trading below the key resistance levels early in the year SOL has been reversing in a range indicating a revival of investors interest. Even when price is constantly evolving in line with the state of the market, recent price fluctuations reveal that SOL has been trading within a range of consolidation, between approximately 120$-160$, which is an expression of wary optimism among the traders as they balance bullish network fundamentals and macroeconomic pressures. Currently, the prices of cryptocurrencies are as follows: (Note: The numbers in the price tables are natural estimates as crypto markets are dynamic markets).

The pattern of price of Solana indicates that explosive rallies in the previous cycles are not as predominant; however, there are consistent accumulations and extensive ecosystem participation which are being made. This is particularly applicable to the long term investors who are interested in monetising the growth in prices as well as utility.

The Reason Solana price trend would be better in 2026.

In the future, a number of things might help SOL to experience positive price dynamics:

Network Adoption Growth: Solana is welcoming an increasing number of DeFi protocols, NFT applications and Web3 applications. On-chain activity or transaction rates may go up, and consequently, the demand of both transaction charges and staking can also increase.

This is because they were interested in institutional Interest: Institutional allocators may develop new interest in SOL as a result of more transparent regulatory models and an expanded on-chain infrastructure.

Stablecoin Expansion: Solana is building up the supply of stablecoins, especially a larger supply of USDC and USDT, allowing it to build deeper liquidity pools and increase trading volumes, which have traditionally been associated with greater price stability.

According to the projections of the market analysts as at 2026, a moderate bullish price movement is possible: given that SOL maintains above the critical psychological support at the levels of approximately $140 and wider crypto recovery, it will be possible to consider the price increases toward $220-280 in the longer-term. It is a long term viewpoint that is based on network expansion in the absence of significant macro shocks.

Nevertheless, it should be highlighted that crypto is volatile in its nature. The future outlook of prices in 2026 is not to be taken as certain but as a directional factor.

The Poain Staking: Incentive and Passive Yields, are introduced.

Although the evolution of the price trends is an essential component of long-term valuation, the emergence of yield-focused projects such as Poain Staking is another significant branch of growth among investors that are not keen on capital gains.

Poain Staking is a new platform, which will allow the end-user to achieve a stable yield on digital assets without the necessity of trading or market-timing digital currencies. In contrast to the classic DeFi construction, where the non-regulated movement of volatile tokens is the only source of returns, Poain Staking uses managed staking contracts and allocation strategies to generate returns.

115$ Reward to New Users – An Early Bonus.

In a bid to attract new participants, Poain Staking is now providing a reward in the form of $115 to any user registering and passing through some initial onboarding procedures. This incentive provides a direct reward on early participation and enables the users to start a staking experience with an instant increase in their balance.

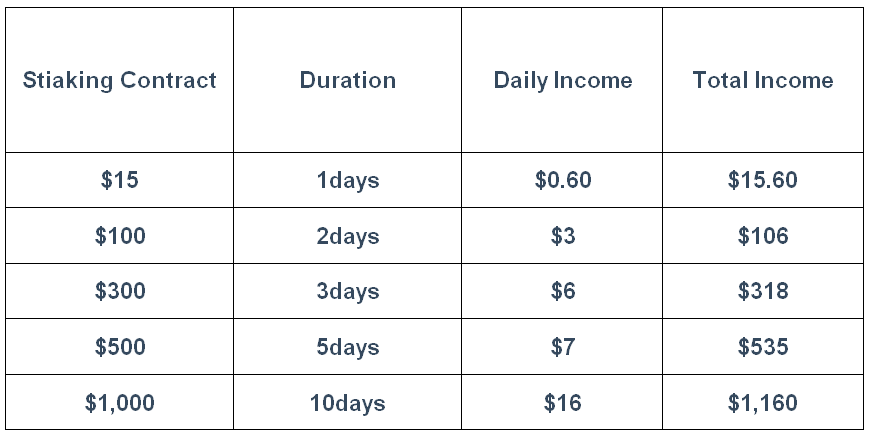

After onboarding, users are offered a range of staking contracts – each has varying durations, yield profile and risk-adjusted strategy of returns. The users can use these contracts to:

Cash tokens in (according to a contract).

Daily or periodic compounding of yield.

Use diversified staking in the assets.

This form is attractive in the contemporary market where price fluctuations tend to keep off investors with the orthodox buy-and-hold approaches.

How Staking Contracts Work

The contract system of Poain Staking enables users to add assets, such as SOL, stablecoins and other accepted tokens, to transparent yield programs. These contracts are constructed to yield returns by participating in networks and optimizing by algorithm, rather than through speculative price movements.

For example:

Stablecoin contracts can produce stable and predictable yield in durations.

Multi-asset contracts Multi-asset contracts may involve combining assets such as SOL with complementary digital assets.

Users are able to monitor earnings and performance rates in real time.

Notably, the model will offer a market protection in case of market fluctuations: although the price of SOL may shift horizontally or suffer short-term declines, the users will still receive tokens due to the active contracts yields.

2026 Prospectus: Diversification Growth.

The convergence of the infrastructure growth of Solana and Poain Staking yield products in 2026 is an investment story to look forward to:

Solana On a Growth Path: Systematic ecosystem growth, DeFi complexity, and a stablecoin iSSO could spur SOL price action in the long term. A prognosis of likely extension to $220- 280 by the end of 2026 indicates a prudently optimistic picture on the basis of adoption and liquidity patterns.

Yield Potential of Poain Staking: Poain Staking finds a stabilizing layer to the investment in crypto by focusing on the stable yields as well as diversified contracts and a new-user bonus of $115. It also enables the users to achieve yield regardless of the fluctuations in the price in the short-term.

Cumulatively, these trends strengthen a strategic strategy in which investors divide the chances of price growth with consistent incomes earnings – a model that can characterize success in the crypto-markets in the upcoming round.

Conclusion

The current development of Solana as a high-speed blockchain paves the way to the possible rise of the blockchain until 2026. Simultaneously, investment tools such as Poain Staking are reinventing the involvement of investors through offering tokens as earnings on contracts, risk-adjusted income, and meaningful onboarding incentives, such as a $115 bonus on new users.

To those who want to explore the future of decentralized finance both in terms of personal growth and income, a combination of involvement in the growing ecosystem of Solana and tactical involvement on Poain Staking could prove a sustainable and prospective investment opportunity.

Media Contact

Company: Poain BlockEnergy Inc

Email: marketing1@poain.com

Official websitehttps://poaintoken.com/

#SOL #Poain Staking #Poain #Solana #Stablecoin

Disclaimer: Cryptocurrency mining and investment involve risks and may result in financial loss. This information is for general purposes only and does not constitute financial or investment advice. Always conduct your own research before participating.