A significant contraction of the LTC price of -78 in the recent future has caused spillovers in the crypto market and has rekindled debates among traders, analysts, and long-term investors. Litecoin (LTC), which is considered as one of the most reliable and established cryptocurrencies, is not exempt of volatility. Nevertheless, the recent price action has once again led to the same issue in the digital asset market: how can investors insure against the abrupt gains and losses in the market and at the same time earn regular returns?

With the increasing levels of uncertainty, the focus has shifted to Poain, a company that has been innovative in its crypto-based contract approach and yield strategies. The question of Poain reintroducing its stablecoin-supported contract, a product that was earlier created to protect the end-user against disproportionate volatility and provide them with a stable income is becoming a matter of concern among many market participants.

The recent LTC Price Contraction.

The 78$ drop in the price of the LTC was not a lone event. Greater market feeling, macroeconomic strain, and variable investor reassurance have added to greater instability in the key cryptocurrencies. It is these forces that affect Litecoin, even with its good fundamentals and long history of reputation.

To short-term traders, this may be a risk and indeed an opportunity. In the case of the long-term investors, the repetitive contractions in prices tend to justify the necessity of alternative methods that minimize the vulnerability to abrupt declines. This is the place where financial products based on stablecoins have got renewed attention.

The Reason Stablecoin-Backed Contracts Are Important.

The stablecoins are intended to take a fixed value, which is normally pegged to a fiat currency, such as the US dollar. Combined with structured contracts, they can offer some predictability that the traditional crypto trading is not usually associated with. These instruments are especially appealing in a volatile period.

Poain had earlier proposed a stablecoin based contract that provided participants to receive returns daily without being directly impacted by intense price movements in assets such as LTC. As the LTC price will come under the gun again, there is a general feeling that maybe it is time Poain re-introduces or improves this solution.

Earnings Model of Poain: Consistency, rather than Speculation.

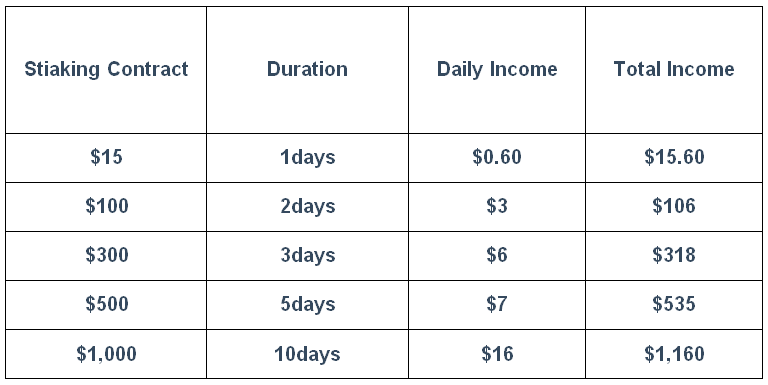

The structure of earning developed by Poain is one of the most debated features of his approach, and its earning structure is clear and measurable. As per the projections available, an investment of 1000 dollars will yield 16$ per day, which translates to 160$ in 10 days. To the investors who are used to the unpredictable returns and losses, this kind of consistency is remarkable.

Instead of using speculative price appreciation, the model created by Poain focuses on structured returns. This is highly appealing to users who do not want to be emotionally drained with tracking of the day-to-day market fluctuations and where the LTC price is on a downward trend.

Sentiment on the market and Psychology of Investors.

Investor psychology is important when assets such as Litecoin are undergoing tremendous contractions. Selling out of fear can be very fast to decline and indecision can leave many participants on the sidelines. In this case, platforms that are stable are likely to have more attention.

It is to this effect that Poain has made his name on circumventing this angst. The company avoids the direct exposure to the fluctuating price movements, which makes it a possible risk taker to market volatility. Should Poain decide to reintroduce its stablecoin-backed contract, it may be a strategic alternative to those who would be temporarily exiting the traditional LTC trading.

Will a Relaunch Have an Impact on the wider market?

Although Poain is not the sole agent that can turn around the LTC price trend, the re-introduction of a stablecoin backed contract would have an impact on how other investors might allocate their funds. In place of dropping out of the crypto business altogether, users can decide to transfer the funds to less risky securities as they await further indicators.

This change would stabilize investor participation at bad times. It is also indicative of an overall trend in the crypto industry, in which financial products are being increasingly diverse and customized to various risk tolerances.

Seeing the Future: What to Expect of Poain.

The eyes are still on Poain on what he should do next in the speculation. The adaptive solutions have been developed by the company in response to the market conditions in the past, and the present environment has a strong argument in favor of innovation. A stablecoin-backed contract would fulfill not only the anxieties emerging due to the recent reduction in the LTC price but also support the sincerity of Poain towards models of sustainable earnings.

Official announcements, especially those containing the terms of the contract, risk management plans, and long-term sustainability, will be under scrutiny with investors. Through transparency and consistency, the issue of maintaining confidence in the current uncertainty in the market will be a possibility.

Conclusion

The recent decline of the LTC by about 78$ has reiterated the unstable characteristics of cryptocurrency markets. Poain is in the middle of increasing speculation as investors look to safer, more predictable means of investing. The possible payoff of the stablecoin-backed contract of Poain with an earning scheme of earning 16$ per day on a capital input of 1000 dollars and earning 160$ in 10 days may provide the solution in time.

With or without a relaunch, Poain, a single fact is evident, in an ecosystem characterized by fluctuation, stability is becoming something of the most precious asset in crypto.

Media Contact

Company: Poain BlockEnergy Inc

Email: marketing1@poain.com

Official website: https://poain.com/

Disclaimer: Cryptocurrency mining and investment involve risks and may result in financial loss. This information is for general purposes only and does not constitute financial or investment advice. Always conduct your own research before participating.