When purchasing a house with a low down payment, there is usually a surprise: mortgage insurance. The concern of many is that this additional cost is not worth it. The reality is that this insurance will allow you to purchase a home more quickly when you are unable to afford the 20 percent down payment, but it increases your monthly payment.

Gaining awareness of these facts is more important than you may realize. For first-time homebuyers, expanding families looking to upgrade, or anyone wishing to enter a growing market in a hurry, understanding the function of this type of insurance can save money and anxiety.

It’s not simply an additional fee; it can be the key to becoming a homeowner when applied effectively. Let’s demystify it together. We are going to discuss how it works, why lenders need it, and how to avoid or cancel it to make the right choice in your case.

How Does Insurance for Mortgages Work?

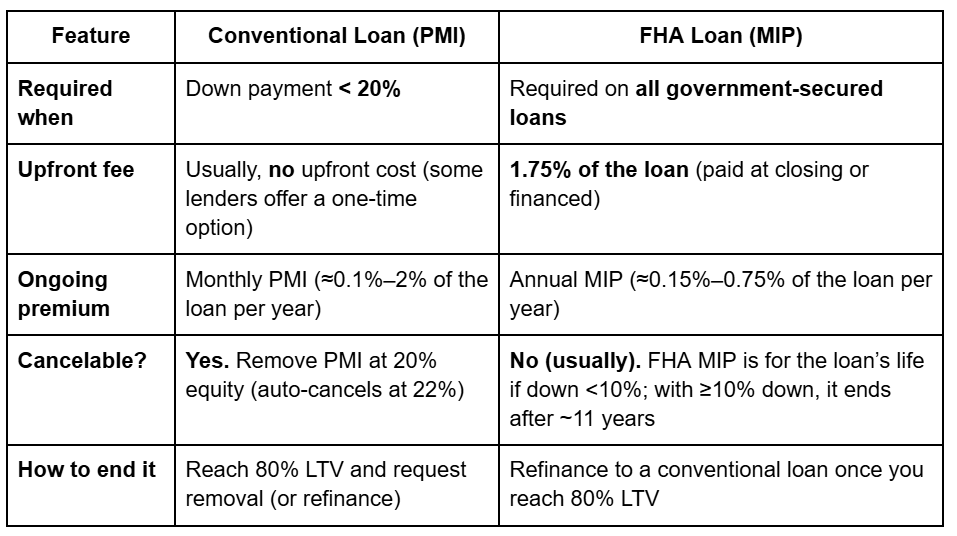

Insurance for mortgages covers your lender (not you) in the event you default. It is what lenders demand when you have a down payment that is less than 20%. On a typical mortgage, you make a Private Mortgage Insurance (PMI) payment every month. Government-insured loans have a Mortgage Insurance Premium (MIP) that has an upfront fee and an annual premium. In either case, insurance for mortgages compensates the lender with a portion of the borrowed amount in the event of default. It does not cover you or pay your mortgage, it just insures the lender.

Why Lenders Need to Insure Mortgages?

Loans that have a small down payment carry higher risks for the lenders. Even borrowers with a 20 percent equity can have very low default rates. To cover the increased risk in low-down-payment loans, lenders require insurance on the mortgage. It serves two main purposes: it secures the lender in the event that you default, and requires smaller down payments, allowing borrowers to buy the property early. The main reasons are:

- Protection: When a borrower defaults, the insurance compensates the lender.

- Lower down payments: It allows buyers to buy houses with 3%–5% down, rather than wait years to save 20%. This adaptability makes homeownership an option.

- Market access: In a rapidly appreciating market, insurance for a mortgage allows buyers to save time. It may take a decade to save 20%, and home prices can rise during that time.

For instance, a buyer bought a house costing $300,000 with 3% down payment. They paid PMI and moved in immediately rather than waiting years to accumulate $60,000. This flexibility was a huge plus.

How Insurance for Mortgages is Paid

Generally, you pay mortgage insurance monthly as part of your payment. The actual cost varies based on your credit score and down payment. Conventional loans charge PMI monthly. FHA Loans (government-insured) charge an upfront charge (typically 1.75% of the loan) and an annual premium that’s tacked onto every payment. The table below compares the two:

Cancelling the Insurance

It’s a good thing that you don’t have the insurance for life (on conventional loans). Once your loan is 80% of the original price of the home, you can ask to cancel PMI. Lenders are legally required to remove it automatically at 78% (22% equity) even if you don’t request it. By contrast, government-secured loans function differently.

If your down payment was less than 10%, FHA insurance for a mortgage usually lasts the term of the loan. If it was 10% or greater, annual premiums cease after 11 years. The simplest method to eliminate FHA insurance for mortgages is to refinance to a conventional loan when you’ve accumulated 20% equity.

Pros and Cons

Like any loan feature, this insurance has upsides and downsides:

Pros

Allows for homeownership with less down payment (usually 3–5%), so you can purchase earlier. It’s the secret to purchasing a home when saving 20% isn’t possible. When you pay off the loan or if home prices increase, you gain equity quicker and can drop PMI later.

Cons

It increases your monthly payment and increases your loan costs. FHA’s yearly premiums can go on forever if you remain under 10% down. If housing prices decline, you may end up paying MI for many years. Simply put, you’re paying for insurance that you will never see the benefit of directly, which some borrowers do not like.

Do You Need Insurance for a Mortgage?

If you can make a 20% down payment (or more) on a traditional loan, you will not require PMI. Borrowers will utilize methods such as an 80-10-10 piggyback loan or a VA loan (which doesn’t have recurring PMI) to sidestep it. If a lesser down payment is your only chance, then insurance for mortgages is the compromise that allows you to purchase now rather than waiting and saving more.

Real-World Example

One buyer put only 7% down on a residence and paid mortgage insurance (PMI). Her PMI premium was roughly 0.5% of the mortgage annually. By the end of 3 years, she had paid sufficient principal that her balance was 80% of the original value of the home. She then asked her lender to drop PMI, saving her money for the remaining term of the mortgage.

The Bottom Line!

Insurance coverage for mortgages isn’t “good” or “bad”; it’s a tool. It allows buyers with lower reserves to purchase homes for a relatively small additional fee.

Understanding how this insurance operates, why lenders ask for it, and when you can drop it gives you the power to plan beforehand. It’s not permanent: with regular payments and increasing home value, PMI can usually be dropped, and FHA mortgage insurance can sometimes be eliminated through refinancing.

Ultimately, it’s a stepping stone, not a detour. Ready to check out your choices? Talk to a skilled mortgage advisor like Mytnick Mortgage Loans today. Seasoned mortgage consultants can review a vast variety of loan programs and determine the best method for your case.

Frequently Asked Questions (FAQs)

- What is insurance for a mortgage?

It’s an insurance policy on your loan that covers the lender in case you default. It’s normally required when your down payment is less than 20%.

- How do I cancel PMI on my loan?

You may ask to cancel once your loan balance is 80% of the home’s original price. Then, the lender is required to exclude PMI (they automatically cancel it at 78% balance).

- Can I avoid paying PMI?

Yes. You will not have to pay PMI if you put down 20% on a traditional loan. Borrowers also opt for VA loans (with no monthly insurance premium) or 80-10-10 piggyback loans to avoid PMI.

- Which home loans don’t require PMI?

Traditional loans with ≥20% down payment do not have PMI. VA loans do not have a monthly insurance premium (they have a one-time funding fee instead). Other loans (FHA, USDA, etc.) have their insurance premiums for covering mortgages.

- Will PMI ever pay me if I default?

No. PMI (and MIP) only pays out to the lender, never to the borrower.