(How Foreign Manufacturers Lose Profit Before First Sale)

Introduction: The Illusion of “Just Ship It”

When Shenzhen-based appliance manufacturer GLEX secured its first U.S. order, leadership celebrated. Six months later, they faced $387,000 in unexpected costs: $112k in Walmart chargebacks, $85k in emergency 3PL termination fees, and $190k in customs penalties.

Their story isn’t unique—78% of foreign manufacturers underestimate U.S. entry costs by 200% or more (McKinsey).

This isn’t about cutting corners. It’s about invisible budget traps that turn profitable products into financial sinkholes. Let’s dissect where profits vanish—and how to stop the bleeding.

Section 1: The 5 Silent Budget-Killers

Compliance Penalties: The $500k “Entry Tax”

Major retailers weaponize compliance:

Walmart’s On-Time In-Full (OTIF) fines: 3% of order value for late/missing items

Amazon’s Prep & Labeling fees: $1.50-$3.00/unit for non-compliant shipments

Pallet rejection costs: $400-$1,200 per failed pallet audit

Real Impact:

*A Mexican food brand lost 22% of Q1 revenue to Target chargebacks after using non-GMO labels unapproved by NSF International.*

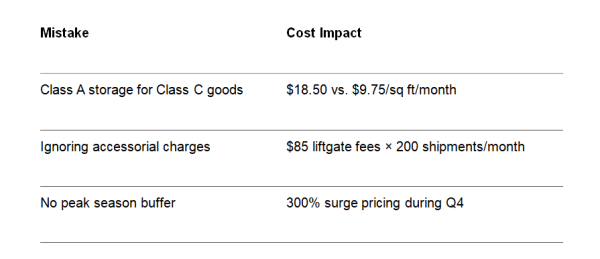

Warehousing Math Errors: Storage That Eats Margins

Choose wrong and pay 40%+ extra:

Case Study:

German auto parts maker over-rented 15,000 sq ft in LA ($277,500/year waste) instead of bonded storage near Chicago’s rail hub.

Tax Landmines: When States Come Hunting

Nexus triggers create domino liabilities:

Physical presence: One sales rep in California = $800/year franchise tax + sales tax

Inventory exposure: Storing goods in 3PL warehouses across 3 states = 3 tax filings

Wayfair Ruling: $100k+ sales in any state = economic nexus

Brutal Truth:

63% of foreign manufacturers receive first state tax notice within 18 months (Deloitte).

Tech Debt: The $200k/year “Quick Fix”

Legacy systems create hidden operational taxes:

ERP Band-Aids: $150/hour consultants patching disconnected workflows

Manual Reconciliation: 23 hours/week wasted merging spreadsheets

Integration Surcharges: $50k+ for connecting “non-friendly” WMS/TMS tools

Red Flag:

If your warehouse manager manually emails shipment data to accounting, you’re losing $18,500/month in productivity (Gartner).

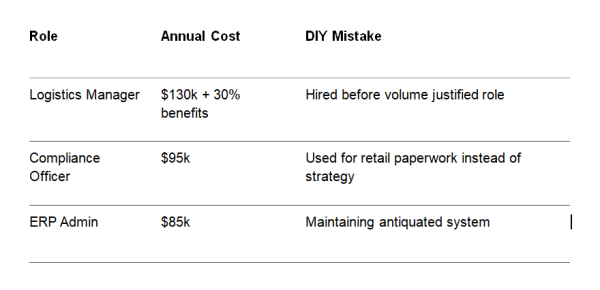

Labor Mismatches: Paying Premiums for Wrong Skills

Hiring U.S. staff too early drains cash:

Section 2: The Strategic Alternative

Why Consolidation Beats DIY

Specialized partners counter hidden costs by:

Preventing Penalties: Pre-loading retailer rules into workflows

Leveraging Scale: 15-30% discounted 3PL/transport rates via pooled volume

Automating Tax Exposure: Real-time nexus monitoring across 50 states

The Proof:

Companies using integrated U.S. entry partners like CrossBridge reduce first-year costs by 41% vs. DIY ($650k vs $1.2M average).

CrossBridge’s Hybrid Model: A Cost-Saving Blueprint

One solution used by EU machinery brands combines:

Compliance Safeguards: AI-powered pre-audits catching 99% of retailer violations

Tech Consolidation: Single dashboard merging ERP, WMS, and tax compliance

Flexible Resourcing: On-demand U.S. logistics experts without full-time hires

Result for client: Korean beauty brand avoided $220k in Amazon fines + saved $147k in 3PL costs via CrossBridge’s pre-negotiated Midwest hub network.

Section 3: Your Cost-Avoidance Checklist

Demand these in every partnership:

3PL Contracts with no minimum volume clauses

Pre-Shipment Validation: ISTA-certified packaging tests + ASN generators

Tax Transparency: Real-time economic nexus alerts

Tech Escapes: Monthly outsourced ERP support <$5k

Peak Buffers: Pre-locked 120% warehouse capacity at fixed rates

Red Flags to Run From:

“We’ll figure out compliance later”

Manual shipment tracking spreadsheets

12-month 3PL commitments pre-revenue

Conclusion: Protect Profit Before Landing

Expanding to America isn’t about courage—it’s about forensic cost control. The manufacturers winning today:

Treat compliance like cybersecurity (proactive, not reactive)

Negotiate logistics before products ship

Replace fixed hires with elastic expertise

As the GLEX team learned too late: “Your U.S. margin is won or lost before container doors open.”

Your next step: Audit these 5 budget-killers in your expansion plan. If any lack bulletproof solutions, remember:

Profitable market entry isn’t about spending more—it’s about bleeding less.